In response to China’s dominance in the global REE sector, North America is positioned to become the largest producer of Rare Earth Metals and Minerals in the World, with over a trillion dollars earmarked for investment over the next twenty years.

Rare earth elements (REE) refer to a group of 17 naturally forming elements in the lanthanide series in the periodic table of elements, including scandium and yttrium. The characteristics of the latter elements possess similar properties to the lanthanides.

The 17 Rare Earths are cerium (Ce), dysprosium (Dy), erbium (Er), europium (Eu), gadolinium (Gd), holmium (Ho), lanthanum (La), lutetium (Lu), neodymium (Nd), praseodymium (Pr), promethium (Pm), samarium (Sm), scandium (Sc), terbium (Tb), thulium (Tm), ytterbium (Yb), and yttrium (Y)

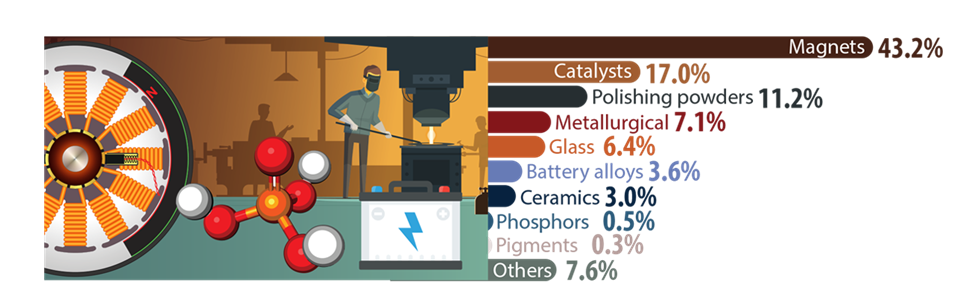

REEs are essential components needed to build and operate electronic devices that we use everyday, such as smart phones, digital cameras, computer hard disks, fluorescent and light-emitting-diodes (LED) lights, flat screen televisions, computer monitors, and electronic displays, smart phones and electronic displays. Large quantities of some REEs are used in clean energy and defense technologies.

REEs are used individually or in combination to make phosphors—substances that emit luminescence—for many types of ray tubes and flat panel displays, in screens that range in size from smart phone displays to stadium scoreboards. Some REEs are used in fluorescent and LED lighting. Yttrium, europium, and terbium phosphors are the red-green-blue phosphors used in many light bulbs, panels, and televisions. The glass industry is the largest consumer of REE raw materials, using them for glass polishing and as additives that provide color and special optical properties. Lanthanum makes up as much as 50 percent of digital camera lenses, including cell phone cameras.

The demand for rare earth elements is expected to grow 400-600 percent over the next few decades, and the need for minerals such as lithium and graphite used in EV batteries could increase as much as 4,000 percent in the same period.

Wind powered turbines use magnets comprised of neodymium, and dysprosium and terbium to counter demagnetization.

Global demand for neodymium is expected to grow 65 percent by 2045. The need for praseodymium and terbium may well exceed supply by 175 percent. Shock demand for graphite, lithium, nickel, and cobalt is expected to exceed supply by 250% by 2050, equivalent. If this level of demand is realized, around 300-400 new mines would be needed to meet demand.

Energy supply, distribution and storage systems that are powered by clean energy technologies, differ significantly from those fueled by hydrocarbon resources.

Solar photovoltaic (PV) plants, wind farms and electric vehicles (EVs) usually require more minerals to build than their fossil fuel-based counterparts. An average sized electric car requires around six times the mineral inputs of a conventional car and an onshore wind utility requires around nine times of mineral resources than a gas-fired plant.

Since 2010 the average amount of minerals needed for a power generation facility has increased by around 40%, as the share of renewables in new investment has risen.

With such demand, greater efficiencies in environmental protection and monitoring is needed to limit the impact on the environment.

Advancing economies continue to accelerate their efforts to reduce green house emissions, transitioning away from their reliance on traditional energy systems, whilst at the same time, ensuring their energy systems remain resilient and secure. Playing into these changes are the need for energy security from sources that are certain and reliable.

Lanthanum-based catalysts are used to refine petroleum. Cerium-based catalysts are used in automotive catalytic converters.

Magnets that employ REEs are rapidly growing in application. Neodymium-iron-boron magnets are the strongest magnets known, useful when space and weight are limiting factors. Rare-earth magnets are used in computer hard disks and CD–ROM and DVD disk drives. The spindle of a disk drive attains high stability in its spinning motion when driven by a rare-earth magnet. These magnets are also used in a variety of conventional automotive subsystems, such as power steering, electric windows, power seats, and audio speakers.

Nickel-metal hydride batteries are built with lanthanum-based alloys as anodes. These battery types, when used in hybrid electric cars, contain significant amounts of lanthanum, requiring as much as 10 to 15 kilograms per electric vehicle.

Cerium, lanthanum, neodymium, and praseodymium, commonly in the form of a mixed oxide known as mischmetal, are used in steel making to remove impurities and in the production of special alloys.

Lithium, nickel, cobalt, manganese and graphite elements are used to enhance and extend battery storage and performance. Rare earth elements are essential for magnets used to design, build and operate wind turbines and EV motors.

Canada

United States

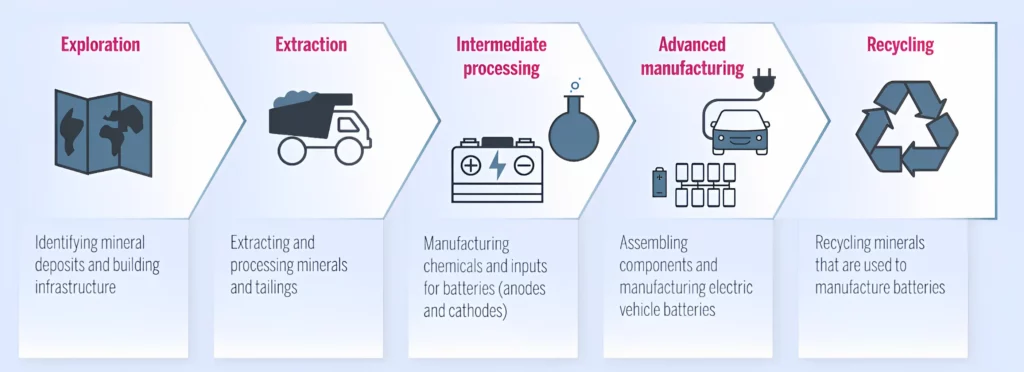

Mining Rare-earth ores is typically done by conventional open-pit methods in which quarry face rock is blasted and loaded into large dump trucks using large shovels. The materials are then transported to a materials separation plant, separating the rocks fragments from REE-bearing minerals.

Our Partnership network comprises professionals in the REE mining sector including, Science and Technology experts, Geologists, Lab-technicians, Quality control and materials testing, Project owners and operators, Market sector leaders and Project Managers, well-versed in mining exploration, recovery, processing and refining. We can guide your project through each stage in the process from partnership and project sourcing, project feasibility studies and assessment, regulatory and permitting to equipment sourcing, mineral exploration and recovery.

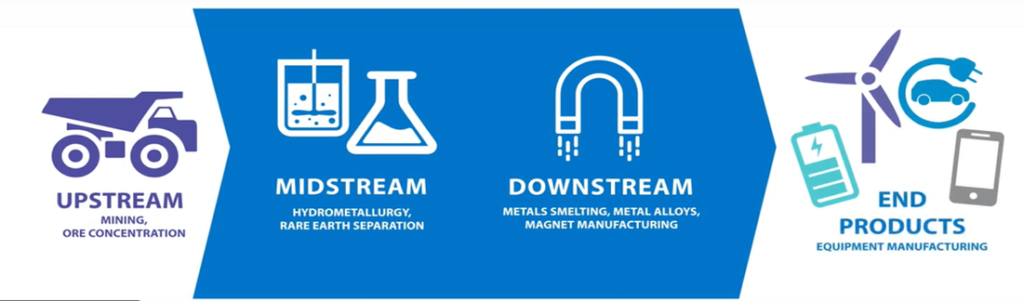

| Upstream | Midstream | Downstream | End products |

|---|---|---|---|

| 1. Sourcing, permitting Mining operations | 3. Hydrometallurgy | 5. Metals smelting, alloys | 7. Equipment manufacturing |

| 2. ORE Concentration | 4. REE materials separation | 6. Magnet manufacturing | 8. Strategic sourcing |

Copyright 2023 BridgeLantic Partnerships | All Rights Reserved. Website created by Sirah Studio